Max out roth ira calculator

It is mainly intended for use by US. Ad Learn About 2021 IRA Contribution Limits.

:max_bytes(150000):strip_icc()/IRArecharacterizationformulaexample-e0acc0d7ed1e40839341e1bcbcc61c4d.jpg)

Recharacterizing Your Ira Contribution

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

. Get Up To 600 When Funding A New IRA. Ad Our Conversion Tool Helps You Determine If Converting To A Roth Is Right For You. There is no tax deduction for contributions made to a Roth IRA however all.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3. Not everyone is eligible to contribute this. We Go Further Today To Help You Retire Tomorrow.

Get Up To 600 When Funding A New IRA. Open A Roth IRA Today. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. We Go Further Today To Help You Retire Tomorrow.

Ad Learn About 2021 IRA Contribution Limits. For 2022 the maximum annual IRA. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed.

Roth IRA Conversion Calculator. In 1997 the Roth IRA was introduced. Subtract from the amount in 1.

This calculator assumes that you make your contribution at the beginning of each year. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. It is important to.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. As of January 2006 there. For the purposes of this.

The amount you will contribute to your Roth IRA each year. The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each year.

For 2022 the maximum annual IRA. This calculator assumes that you make your contribution at the beginning of each year. In 2022 the maximum annual contribution you can make for a Roth IRA is 6000 depending on your filing status and modified adjusted gross income MAGI.

Married filing jointly or head of household. If youre under 50 in 2022 you. Roth IRA Calculator Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

Roth Conversion Calculator Methodology General Context. For 2022 the maximum annual IRA. While long-term savings in a.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during.

Max Out 401K And Roth Ira Calculator Overview. For comparison purposes Roth. The amount you will contribute to your Roth IRA each year.

Ad Explore Your Choices For Your IRA. To maximize its advantages you need to focus on maximizing your contributions. Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

Hitting that threshold looks different depending on your age. Open A Roth IRA Today. Max Out 401K And Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the.

Explore Choices For Your IRA Now. This calculator assumes that you make your contribution at the beginning of each year.

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

Roth Ira Income Limits 2022 Nerdwallet

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Ira Calculator Roth Deals 52 Off Ilikepinga Com

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

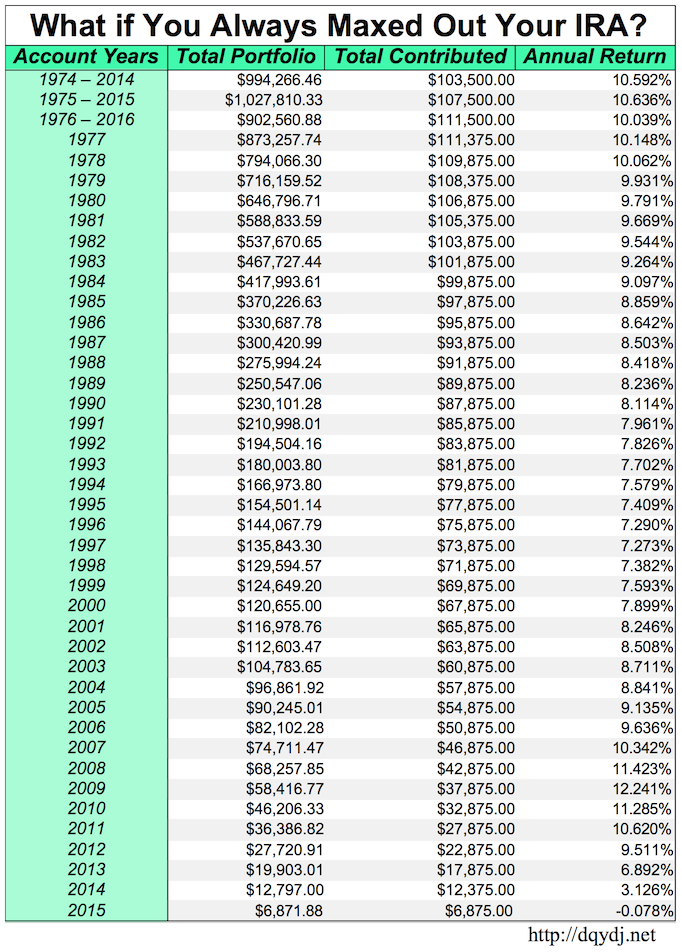

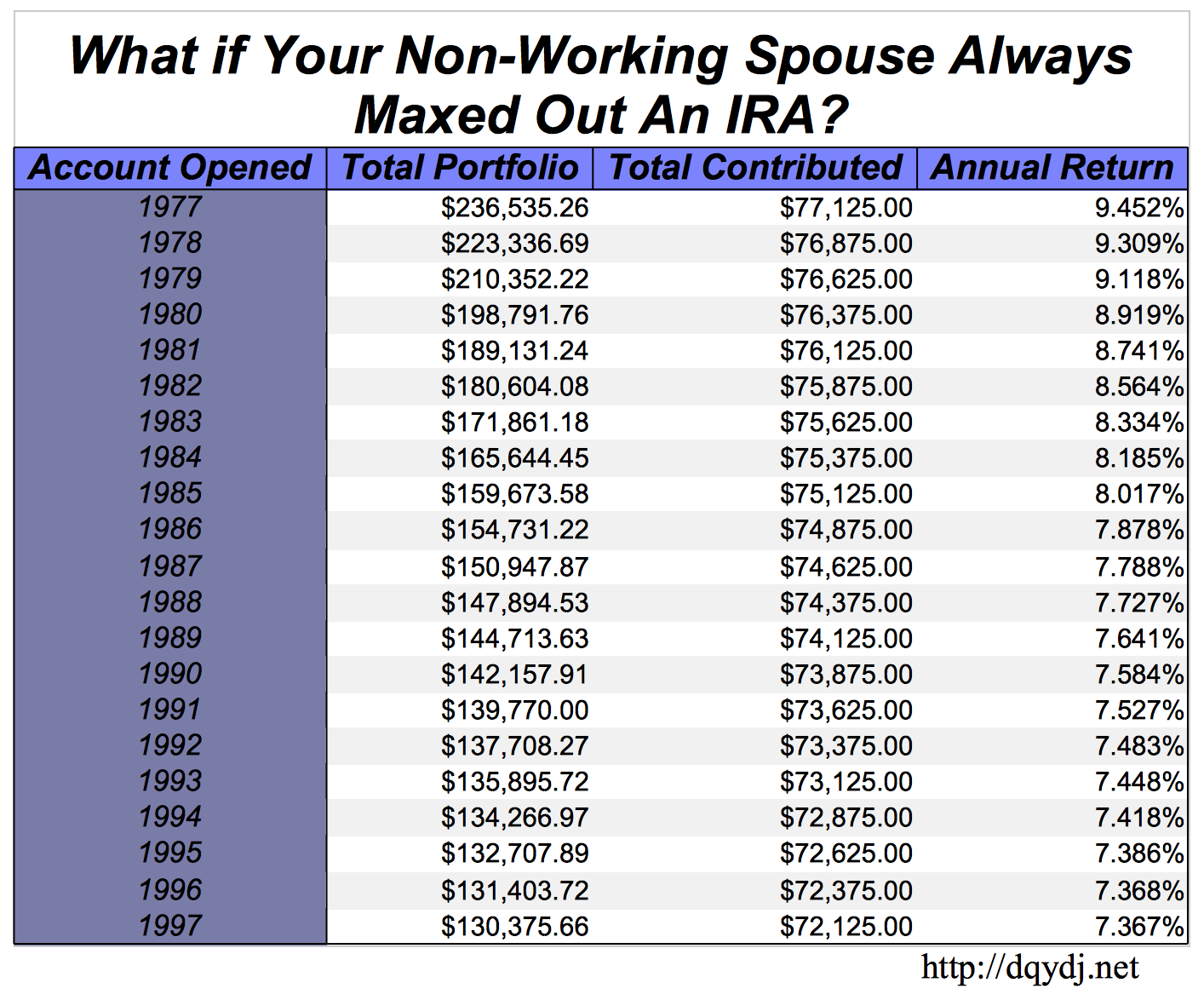

What If You Always Maxed Out Your Ira Seeking Alpha

How Roth Ira Contributions Are Taxed H R Block

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Roth Ira Calculator 2022 Thrivent

Pin On Parenting

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Best Roth Ira Investments Bankrate

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Money Saving Strategies

What If You Always Maxed Out Your Ira Seeking Alpha